IN THE NEWS

A New Kind Of GP Stake Deal: Billionaire-Backed Nile Capital Takes Minority Stake In VC Firm Wilshire Lane Capital

News . August 13, 2021

Source: Forbes

In the booming private equity and venture capital industries, fast-growing firms like Clearlake Capital and New Enterprise Associates have been able to turn to funds built to buy minority stakes in investment firms, giving them new capital for growth. Now, the market for staking these general partnerships is expanding to include newer firms, often with founders from diverse backgrounds looking for early-stage capital to build the infrastructure necessary to win the confidence of large pensions and endowments.

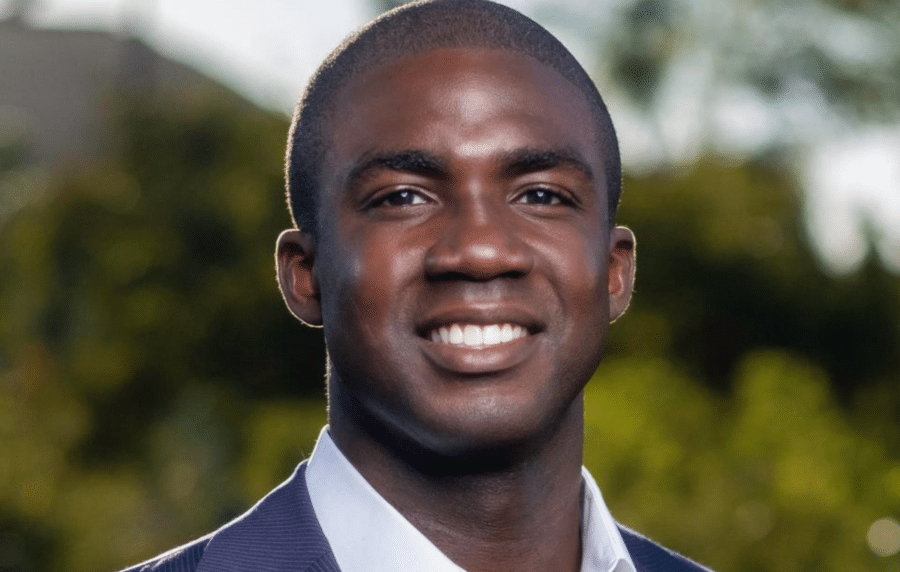

On Friday, Wilshire Lane Capital, an early-stage venture capital firm led by Adam Demuyakor, 32, announced it would sell a minority interest to Nile Capital Group, a firm that stakes general partnerships. Demuyakor, a venture capitalist who worked at blue-chip firms Andreessen Horowitz and Fifth Wall Ventures, founded Wilshire Lane in 2019 to invest in early-stage real estate technology companies, which are growing quickly as landlords repurpose retail and office assets into residential, self-storage, and logistics space.

After leading 14 early-stage investments including storage startups Neighbor, Saltbox, and Stuf Storage, remote-work marketplace WorkChew and cloud kitchen unicorn Kitopi, Demuyakor wanted to begin institutionalizing Wilshire Lane to draw interest from larger allocators like endowments and pensions. His friend Henri Pierre-Jacques, co-founder of TPG Capital and KKR-backed Harlem Capital recommended Demuyakor reach out to José E. Feliciano of Santa Monica-based private equity firm Clearlake Capital, who alongside his wife Kwanza Jones, had backed many diverse-led investment firms through their SUPERCHARGED Initiative, including Harlem Capital.

About a year ago, Demuyakor met with Feliciano, a billionaire who co-heads Clearlake Capital, one of the private equity industry’s fastest-growing firms with $38 billion in assets under management. Feliciano recommended Demuyakor begin to institutionalize Wilshire Lane, beefing up its operations, distribution, and marketing. He and his wife Jones had also been looking to systematize their backing of diverse investors by taking a minority position in Nile Capital. The firm, built by former Julius Baer Investment Management executive Mel Lindsey in 2014, invests in the partnerships of diverse, and emerging asset management firms with niche investment styles.

Lindsey’s Nile Capital had already led a handful of deals including in female-led quantitative investment firm Strategic Global Advisors, Denali Advisors, a Native American-owned asset manager, and Convergence Investment Partners, an African American-owned that is repackaging long-short hedge fund strategies into mutual fund and ETF formats. With the backing, Nile Capital often has helped to scale these firms by billions of dollars in assets under management. For Lindsey, the creation of Nile Capital drew on a lengthy Wall Street career where most prominently helped build Julius Baer’s investment management business from $800 million (assets) to a peak of $78 billion. After the business was listed and then sold, Lindsey decided to create Nile Capital to offer diverse GPs strategic capital and hands-on help in building infrastructure like operations, sales, marketing, and distribution to emerging managers.

After months of negotiation, Lindsey’s Nile Capital will buy about 25% of Wilshire Lane for an unspecified price, while the majority of ownership will stay with Demuyakor. Stealth until mid-2020, Wilshire Lane has invested well over $10 million in property tech startups, often alongside bigger investors such as FJ Labs and his former employers Andreessen Horowitz and Fifth Wall Ventures. Demuyakor wants to grow bigger to capitalize on real estate markets in transition.

“It’s a match made in heaven,” Demuyakor tells Forbes. “This will be instrumental in Wilshire Lane taking that next step and being able to raise more capital for the exciting property technology space. For me, now moving into building an institutional-focused firm, it’s helpful to have people around the table who have done it before.”

Nile Capital’s Lindsey sees a big opportunity in the real estate technology investing niches that Demuyakor specializes in, like remote-working, last-mile logistics, self-storage, and new business models for restaurants.

“We are in a pretty dramatic shift in how people think about real estate,” says Lindsey. “With property-technology, as companies transition from being asset-heavy real estate owners to using data and technology to become more asset-light, there is tremendous value being created. It’s why we think Wilshire Lane Capital is in such an exciting space.”

Born the son of immigrants from Ghana, Demuyakor grew up in Gwinnett County, Georgia, about an hour north of Atlanta. He first worked on Wall Street after taking an analyst role at investment bank Morgan Stanley after graduating from Harvard with an undergraduate degree in 2011. Then, after a stint as an associate at private equity giant Carlyle Group, Demuyakor matriculated to Harvard Business School in 2015. During his studies, as the asset-light business models of Airbnb, Uber, WeWork, and Doordash took flight, he became interested in the changes that technology was bringing to the real estate world.

As he headed to graduation from HBS, Demuyakor joined Fifth Wall Ventures in 2016, a venture firm specialized in real estate technology, to get an insiders’ view of the industry. After two years at Fifth Wall, he set out on his own and founded Wilshire Lane. Demuyakor has been an active investor and recently found himself invested alongside his former employer Fifth Wall after it led a $53 million Series B investment in self-storage sharing app Neighbor.

“It’s an incredibly exciting time and prop-tech or real estate tech,” says Demuyakor. “With the COVID-19 pandemic, there’s just so much change that’s occurring in the real estate industry. You’re seeing lots of debates on whether people will return to the office, or stay remote, and there’s debate on the future retail and malls. In the end, technology will have a big say and how this real estate will be used on a go-forward basis.”

Add Feliciano and Jones in a statement. “We are excited to work with Nile and Wilshire Lane Capital to support Adam’s efforts as a go-to partner for PropTech companies, and believe the platform is uniquely positioned in a rapidly expanding market… [We] have been dedicated to supporting the best and brightest investment managers and have seen how impactful the right guidance and access to capital can be on the trajectory of an investment firm. We are committed to giving them a much-needed boost.”

Share this article: